- What Is Form 2290

- Who Must File

- When To File

- How To File

- What Info Is Needed File

- Taxable Vehicles

- Suspended Vehicles

- Logging Vehicles

- Agricultural Vehicles

- Credit Vehicles

- Determining Taxable Gross Vehicle Weight

- HVUT Tax Calculation

- What Is Schedule 1

- Payment Options

- Taxable Gross Weight Increase Filing

- Penalties

- Benefits of e-filing

- Exemptions

- Form 2290 IRS Contact

- Records Retention

IRS Form 2290 Heavy Vehicle Use Tax Guide

Are you a heavy vehicle truck owner who is required to file the IRS Form 2290? If so, you may be wondering what the form is and how to complete it. In this resource guide, we will provide an overview of the Form 2290, including what information is required and when it must be filed. We also provide tips on how to make the filing process easier. So if you're ready to learn more about the Form 2290, keep reading!

What is the Form 2290?

The Form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more that is used on a public highway. The Form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system.

In 1982, Congress passed the Surface Transportation Assistance Act, which included the Heavy Vehicle Use Tax (HVUT). The tax was put into place so that there would be funds available to fix public highways and pay for other maintenance costs incurred by heavy motor vehicles driving on them. Highway motor vehicles with a taxable gross weight of 55,000 pounds or more are required to pay the excise tax annually to the IRS when registering their vehicles with the state office. The rates for the excise taxes vary depending on the weight category of the highway motor vehicle, if it is used exclusively as a logging vehicle, whether it is used for agricultural purposes and if the highway motor vehicle qualifies as a suspended vehicle. Prior to renewing the registration of the highway motor vehicle each year, truck owners must file Form 2290 with the IRS and pay any applicable excise taxes based on the taxable gross weight of the vehicle. The funds collected from the heavy vehicle use tax help pay for repairs needed on the highways damaged by heavy highway motor vehicles, as well as supporting bridge construction and improvements to highway safety. Highway motor vehicles that are required to pay the excise taxes are an important source of funding for maintaining our nation's roadways.

You will need to file Form 2290 each year that you own and operate a heavy highway motor vehicle. The tax year for the Form 2290 runs from July through June of each year.

Who has to file a Form 2290 heavy vehicle use tax return?

You must file a return if you are the owner or registrant of a highway motor vehicle that:

- Has a taxable gross weight of 55,000 pounds or more, and

- Is used on public highways during the tax period.

You could be an individual, corporation, partnership, limited liability company (LLC), or any other type of organization who is registered with the state, District of Columbia, Canadian, or Mexican law as the owner of the vehicle.

Qualified subchapter S subsidiaries (QSubs) and disregarded entities with a single owner are treated as separate entities for the heavy vehicle use tax filing purposes. These entities must file and pay the excise tax under the employer identification number (EIN). An owner may not file Form 2290 with a social security number (SSN) or with the owner’s taxpayer identification number (TIN). Most QSubs and disregarded entities already have an EIN that can be used when filing the Form 2290. You may call the IRS Business and Specialty Tax line at 800-829-4933 if you are not sure if an EIN has been issued for your organization. You may apply for an EIN at the IRS prior to filing the Form 2290.

If a registered vehicle is under both the owner's name and another individual, the owner is responsible for the tax. The same goes for leased vehicles that are dual-registered.

Any vehicle with a dealer’s tag, license, or permit is considered registered to the dealer.

The excise tax is based on the weight of the vehicle. You do not have to pay the tax on a vehicle that weighs less than 55,000 pounds. This tax applies to vehicles used for farming and those used for non-farming purposes such as construction or transportation. Failing to file this form can result in penalties and interest, so make sure to fulfill your duty as a responsible business owner and file your 2290 form on time. Don't wait until it's too late.

When is the Form 2290 heavy vehicle use tax return due?

The tax year for the IRS Form 2290 starts on July 1st and runs through June 30th of every year.

The tax is due on the first day of the month following the month in which the vehicle was first used on a public highway. For example, if you first use your taxable highway motor vehicle on a public highway in July, the Form 2290 must be filed and the tax paid to the IRS by August 31st. If the due date falls on a weekend or holiday, you may file by the next business day.

If you purchase a vehicle during the year and use it on any public highways, you must file Form 2290 and pay the tax for the part of the year that the vehicle was in service. For instance, if you purchase a taxable highway motor vehicle on March 15th and use it on any public highways during March, you must file Form 2290 and pay the taxes due by the end of April. You will only need to pay taxes on the vehicle for the months it was in service during the taxable period.

If you first use multiple vehicles in a span of more than one month, then separate Form 2290 filings must be completed for each individual month.

The filing deadline isn’t tied to the vehicle registration date. Regardless of the vehicle’s registration renewal date, you must file Form 2290 by the last day of the month following the month in which you first use the vehicle on a public highway during the tax period.

Keep in mind that the filing deadline for Form 2290 has nothing to do with when you renew your highway motor vehicle registration. You must submit the Form 2290 by the last day of the following month after first using a public highway during the tax period, no matter when your vehicle's registration expires. The Form 2290 filing deadline is not associated with the vehicle's registration, renewal or IRP filing.

How to file Form 2290 heavy vehicle use tax return?

You can file your Form 2290 electronically using an authorized e-file provider or paper file by mailing it to the IRS. Choosing to e-file Form 2290 is faster, easier and more accurate than paper filing. You will also receive the watermarked Schedule 1 document almost immediately after electronically filing the 2290 online.

What information is required to file Form 2290?

To file a Form 2290, you will need to provide the following information:

· Business name, address, and employer identification number (EIN)

· The vehicle identification number (VIN)

· The total weight of the vehicle or taxable gross vehicle weight

· The date the vehicle was first used on any public highways during the tax period that runs from July 1st through June 30th

What is considered a Taxable Vehicle?

A taxable vehicle is any vehicle that is registered and used on public highways to carry a load with a taxable gross weight of 55,000 pounds or more. Trucks, semi-trucks, truck tractors and buses are considered highway motor vehicles. Generally, vehicles including vans, pickup trucks, panel trucks, and similar trucks don’t have to pay this tax because they are not considered highway motor vehicles that carry a load on a public highway of 55,000 pounds or more.

In the United States, any road open to public use that isn't a private roadway is considered a public highway, regardless of who maintains it. This includes roads at the federal, state, county, and city level.

For example, if you bought a large truck that qualifies as a taxable vehicle from the dealer and drove it on any public highways to your house, the journey home would be considered your first taxable use of the vehicle.

What is a Low Mileage Suspended Vehicle when filing the Form 2290?

If you do not use your vehicle on public highways enough to meet the minimum mileage requirements, but still want to keep your vehicle registered, you may file a Form 2290 and report the vehicle as a low mileage suspended vehicle.

Tax suspended vehicles designated as category "W", also commonly known as low mileage vehicles, are vehicles that have been used on public highways that do not exceed 5,000 miles (7,500 miles for agricultural vehicles) during the tax period. These suspended vehicles are not taxed by the IRS. All low mileage suspended vehicles must still be reported to the IRS.

If you have a low mileage vehicle, you will need to file a Form 2290 and report the VIN on the "Low Mileage - Suspended Vehicles" screen. You will not owe any taxes for these vehicles, but you will still need to file Form 2290 and report them to the IRS.

Logging Vehicles

Logging vehicles are assessed a reduced tax amount. In order for a vehicle to be considered a logging vehicle, it can only be used for the transportation of products that have been harvested from a forested area and it is registered with the state for transportation of harvested forest products only. No special tag or state license plate is required.

e-Filing provides instant processing of your 2290 return

Agricultural Vehicles

If you use a vehicle primarily for farming purposes and the agricultural vehicle is registered under state laws as a vehicle used for farming purposes for the entire Form 2290 tax period, you may be eligible for the agricultural vehicle exemption. This exemption applies to agricultural vehicles that are used less than 7,500 miles on public highways during the tax period.

You primarily use a vehicle for farming if over half of the time you spend using it (based on mileage) is spent on farming activities.

Credit Vehicles

If a highway motor vehicle on which you have paid the tax is sold, destroyed or stolen during the tax period, you may claim a credit or refund. Tax credits can be automatically applied when e-filing the Form 2290 on our system to help reduce any taxes owed on a new truck.

If you filed and paid HVUT (heavy vehicle use tax) on vehicles from the previous tax period, but did not exceed the 5,000 miles threshold (7,500 for agricultural vehicles), you may claim a tax credit.

These tax credits can be automatically filed on our system so that you can immediately receive the IRS refund when you file Form 2290 online.

How to calculate the taxable gross vehicle weight?

The amount of tax you owe is based on the taxable gross weight of your vehicle. Calculating the taxable gross vehicle weight of a vehicle for the Form 2290 can seem daunting, but it is actually rather straightforward.

- Determine the unloaded weight of your vehicle. This includes the weight of the chassis, all accessories, a full supply of fuel and any permanent attachments, such as a toolbox.

- The unloaded weight of trailers or semitrailers that are fully equipped for regular use in combination with the vehicle. A trailer or semitrailer is considered to be regularly used in connection with a vehicle if the vehicle is equipped to tow the trailer or semitrailer.

- Finally, add in the maximum weight carrying capacity of the vehicle and any trailers or semitrailers customarily used with the vehicle.

The sum of all these numbers is your taxable gross vehicle weight. By following these steps, you can easily calculate your vehicle's taxable gross vehicle weight for the Form 2290.

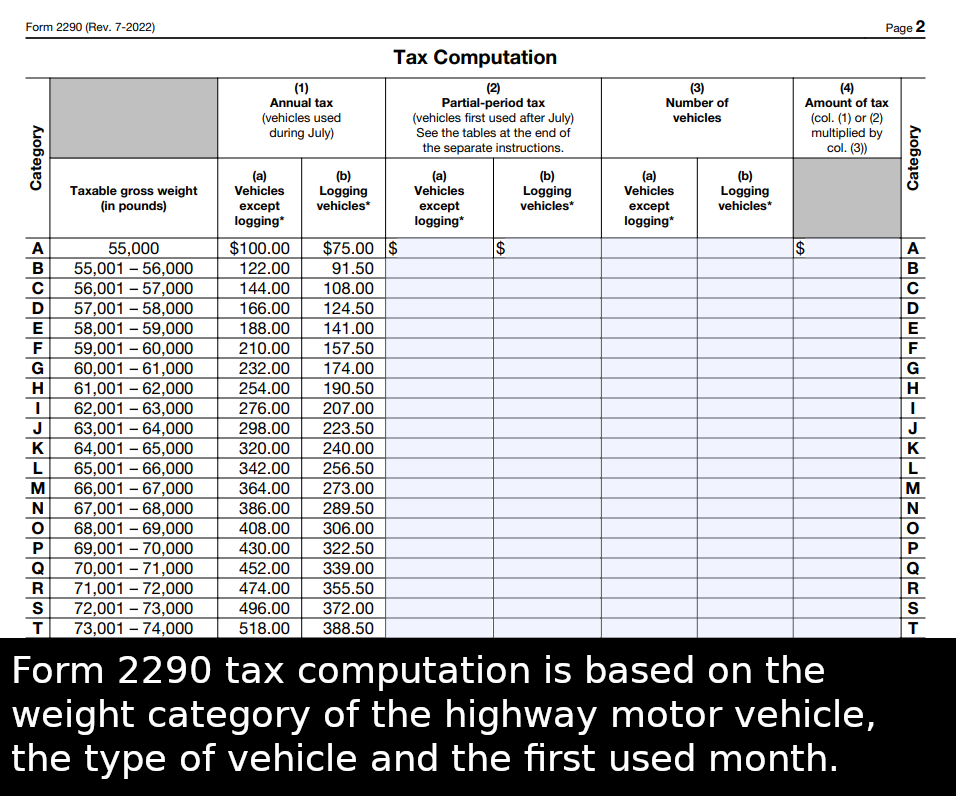

How much is the heavy vehicle use tax?

The excise tax for a highway motor vehicle includes a rate of $100 plus $22 for each 1,000 pounds of taxable gross weight in excess of 55,000 pounds. The maximum tax liability that can be imposed on a highway motor vehicle is $550 which is assessed to highway vehicles with a weight category of "V" - 75,000 pounds or more. A logging vehicle is assessed a reduced tax amount. Taxable vehicles with a month first used date other than July have a prorated tax amount, since they are not used the entire tax period, July 1 - June 30.

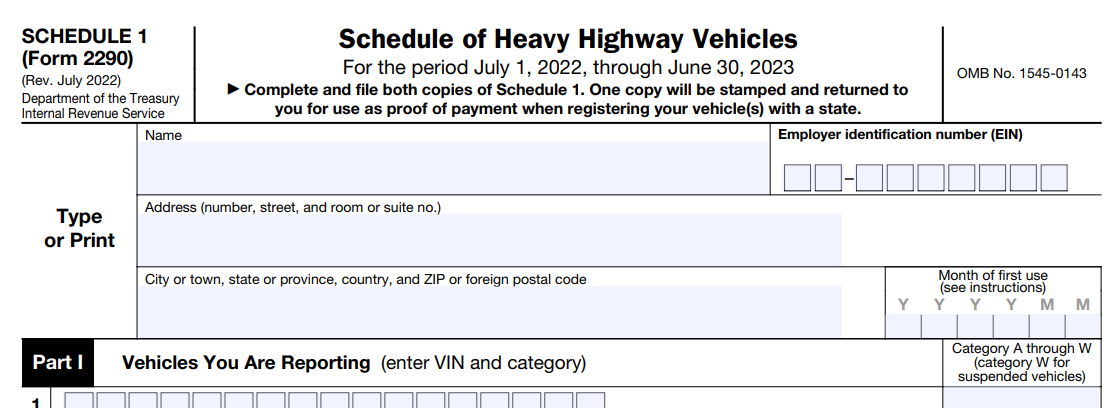

What is the Schedule 1 document?

If you file Form 2290 and pay the tax, you will receive a Schedule 1 which serves as proof of filing and payment to the IRS. The Schedule 1 is also required by the state licensing office for the vehicle registration and renewal. The Schedule 1 of the Form 2290 shows the vehicle identification number (VIN), the total tax paid, the beginning and ending dates of the period covered by the payment, and the date of approval. The 2290 e-file provider instantly obtains your Schedule 1 document directly from the IRS after the Form 2290 has been electronically processed and approved with the IRS.

What are the payment options for the heavy vehicle use tax when filing the Form 2290?

You can make the payment for your heavy vehicle use tax using one of the following methods:

· Electronic Funds Withdrawal - When you e-file Form 2290 online with an authorized e-file provider, you can choose to have your taxes withdrawn directly from your checking or savings account. This is the fastest and easiest way to pay your heavy vehicle tax. There is no extra step required.

· Check or Money Order - You can make your payment by check or money order after you e-file the 2290 online. The 2290-V payment voucher will automatically be sent to you after the 2290 return has been processed and approved with the IRS on our system. Make the check or money order payable to the "United States Treasury" for the full amount of the tax due. Be sure to include your name, your employer identification number and "Form 2290" on the front of the check.

· EFTPS - The Electronic Federal Tax Payment System (EFTPS) is a free service provided by the Department of the Treasury. You can use this system to pay your heavy vehicle use taxes electronically. To use this system, you will need to enroll in EFTPS and have your bank account information available. After you have enrolled and received your PIN, you can make your payment by going to the EFTPS website. To ensure your EFTPS payment arrives on time, you must submit the payment by 8:00 p.m. Eastern time the day before its due date.

· Credit or debit card - You can pay your heavy vehicle use taxes with a credit or debit card by going to IRS.gov/PayByCard, but note that there is a convenience fee charged by these service providers.

How do I increase the weight category of a vehicle after I have filed a 2290 return?

If you have already filed a 2290 return and paid the tax for a vehicle, but later find that the taxable gross weight of the vehicle needs to be increased, you can file an amended return also known as a Taxable Gross Weight Increase (TGWI) filing. You will only need to amend the VIN that has a weight increase. TGWI filings are fast and easy when e-filing the Form 2290 on our system.

What are the penalties for not filing a Form 2290 heavy vehicle use tax return?

If you do not file Form 2290 and pay the heavy vehicle use tax due, you may be subject to a failure-to-file penalty. The penalty is 4.5% of the total tax due for each month or part of a month that the return is late, up to a maximum of five months. In addition, you may be subject to a late monthly payment penalty of 0.5% of the tax not paid by the due date, plus 0.54% interest accrual each additional month.

The deadline for filing this form is August 31, and it's important to make sure you submit it on time. Our system will accurately and automatically calculate the correct heavy vehicle excise taxes based on the taxable gross weight of each submitted heavy highway vehicle. If you're not sure how to complete the Form 2290, or if you need help filing it, our experienced support can help. We have years of experience working directly with the IRS, and we'll make sure your Form 2290 is filed correctly and on time.

What are the benefits of e-filing the Form 2290 heavy vehicle use tax return online with us?

E-filing the Form 2290 online is the fastest and easiest way to file your 2290 tax return and make your payment. When you e-file with an authorized IRS e-file provider, your return will be transmitted electronically to the IRS in minutes. Once we process and get approval of the 2290 return with the IRS, you will receive your Schedule 1 document via email and the Schedule 1 will be saved to your online account for download at any time.

Are there any Form 2290 exemptions?

You don't have to report the use of certain highway vehicles on a Form 2290 if the highway vehicle is used and operated by any of the following groups:

- The federal government

- A state or local government including the District of Columbia

- The Red Cross

- A nonprofit volunteer fire department, ambulance association, or rescue squad

- An Indian tribal government

- A mass transportation authority

You also don't have to file a Form 2290 if you use a qualified blood collector vehicle or a vehicle that is not considered a highway motor vehicle. Examples of these vehicles include mobile machinery for non-transportation functions, road rollers, ditch-digging apparatus, and well-drilling machinery.

To learn more about the exemption details for the IRS Form 2290 go to the IRS 2290 Instructions.

How do I contact the IRS with questions about my Form 2290?

If you have questions about your Form 2290, call the IRS Form 2290 help site Monday through Friday from 8:00 a.m. to 6:00 p.m. ET, for immediate assistance.

- USA: 866-699-4096

- Canada or Mexico: 859-320-3581

The IRS support representative will be able to review your Form 2290 filing. Spanish-speaking support representatives are also available.

Form 2290 Records Retention

Hold onto records of any taxable highway vehicles registered under your name or entity's name for at least 3 years after the tax is either due or paid. When e-filing the 2290 online with our system, the Schedule 1 will be saved to your online account available for download. Previously filed 2290 returns may also be available for download so that your 2290 filings are easily accessible in a central location.